The Horton Team

Our mission, first and foremost, is to understand you and what matters most to you. Armed with that information we can ask thoughtful questions -- listening carefully, then understanding in detail where your wealth stands today and where you’d like it to be tomorrow. We help you design and implement a personalized plan intended to help you and your family pursue financial goals while helping manage investment risk. Our approach is to focus on potential solutions that can help turn goals into reality.

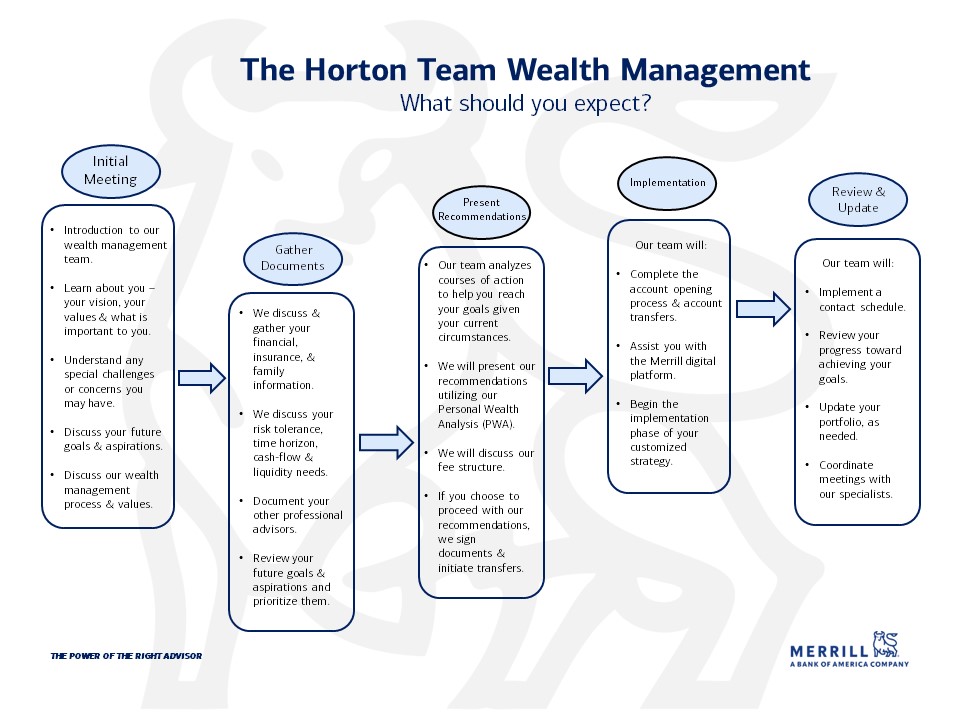

As a new client to our team, we feel it's important you know what to expect:

• Initial Meeting – This is where we get to know what makes you, YOU! Our team strives to provide a comfortable and engaging environment where we can get to know what's most important to you. What are your values, your goals, your hopes for the future? Do you want to buy that second home you've been dreaming about, or are you just hoping to retire comfortably and leave what's left to your family? Whatever your aspirations – we are here to help you make a plan.

• Gather Documents – In order to create a financial plan, we'll need to assess your risk tolerance, time horizon, and cash-flow needs. We ask that you provide statements for current retirement/investment accounts, insurance policies, and any other assets that will help guide us towards the "big picture." We will review your goals and help you prioritize them.

• Present Recommendations – Once we've gathered the information we need to formulate your financial plan, we will present our recommendations through our Personal Wealth Analysis (PWA) tool. This tool allows us to input data in real-time, showing you different scenarios with varying outcomes (like retiring at age 67 vs. age 65). We will discuss our fee structure, and if you choose to proceed with our recommendations, we will sign necessary documents and initiate transfers.

• Implementation – Our team will assist you every step of the way. We will complete the account opening process and transfers, we will assist you with the Merrill digital platform (setting up the app and getting logged onto your unique web portal), and we'll begin the implementation phase of your custom strategy.

• Track and Update – We will contact you according to your stated contact preferences. We service clients all across the United States, and we work with your schedule to find times and locations to meet with you. Our team will consistently track your progress towards achieving your goals and update your portfolio, as needed.

CIMA®, CPFA®

CFP®, CKP®, CPFA®

CEPA®, CKP®, CPFA®, CRPS™

Bringing fresh perspectives to your financial life

The financial decisions you make today can help determine the future you build for yourself and your family. Carving a clear path forward starts with connecting your life and finances. A Merrill advisor provides access to the investing insights of Merrill and banking capabilities of Bank of America to help you make informed decisions as you pursue your goals.