Waarbroek-Lin Group

Managing your wealth begins with a deep understanding of your full financial picture. Based on what matters most to you, we will help create a strategy to meet your goals. Drawing on the deep resources of our firm we will consider all avenues possible to solve each individual goal. We actively utilize tax management strategies through direct indexing, we are very active in the use of alternative investments, and we have a very robust knowledge of the corporate retirement planning space as Retirement Benefits Consultants whom are qualified to handle 401K plans $10 MM+, in addition to two decades plus of experience tax deferral strategies such as cash balance and tiered profit sharing plans. If you are considering gifting to family or charities, we will be your one point of contact to consider all of the many opportunities available to you.

*Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

**Some or all alternative investment programs may not be in the best interest of certain investors. No assurance can be given that any alternative investment’s investment objectives will be achieved.

As a new client to our team and our firm we think it is very important that you know what to expect.

Our team consists of three Financial Advisors: Shane Waarbroek (@ ML since 2003), Grace Lin (2005), and Mingjie (MJ) Xu (2018).

- Your first point of contact will be with Grace. She will have an in-depth conversation with you to learn more about your entire financial situation, which will be compiled into your Personal Wealth Analysis (PWA). We will focus on your financial goals which may include retirement, legacy and estate, charitable, educational, and any aspirational goals. She will then set a follow up appointment for 2-3 weeks from the first call.

- Mingjie (MJ) will put together the PWA using the information that you conveyed to Grace and all financial documents that we have on hand. She will conduct scenario analyses to optimize a path forward for your family.

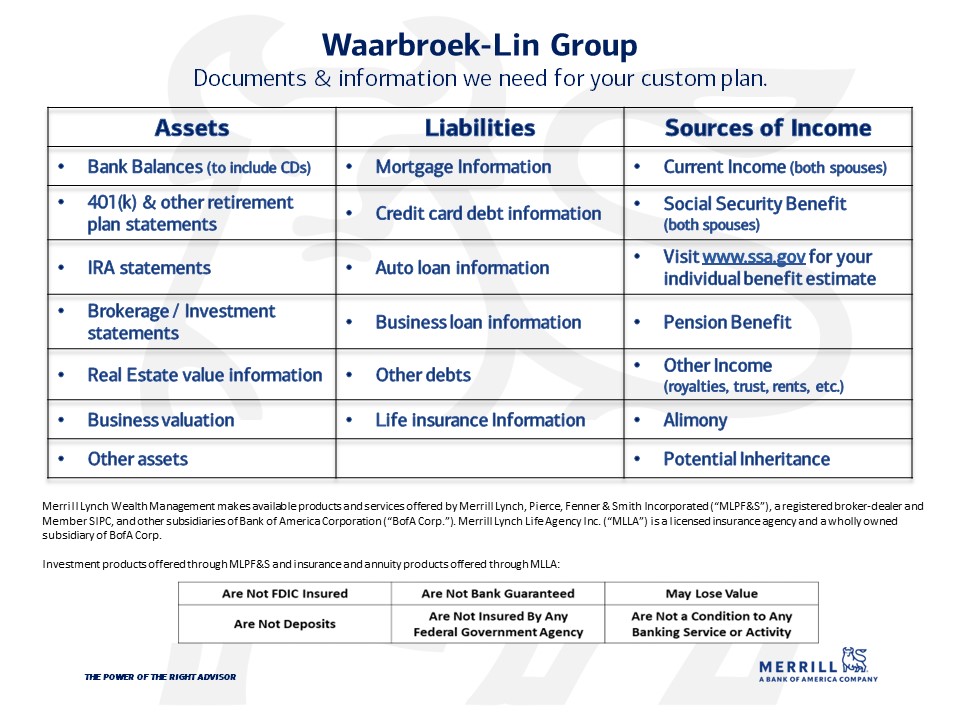

Important Documents we'll need: see Important Documents needed to conduct PWA (above and to right)

- Shane will then work with the team to develop an investment proposal that best fits your existing portfolio and future needs.

- Taxes are our first consideration. For your trust and taxable accounts, we will evaluate whether or not your existing portfolio has large unrealized gains and whether or not we want to maintain the holdings with large unrealized gains.

- We will look into direct indexing and tax efficient management strategies as part of our overall transition strategy.

- Our liquid stock and bond portfolios are run through our Chief Investment Office which uses the best thought research of our firm.

- We will then consider how Alternative Investments (AI) may fit into our overall strategy. AI can consist of Private Equity, Private Real Estate, Private Credit, Infrastructure, and more.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Some or all alternative investment programs may not be in the best interest of certain investors. No assurance can be given that any alternative investment's investment objectives will be achieved.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., ("Bank of America") and Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S" or "Merrill"), a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of Bank of America Corporation ("BofA Corp.").

* Extel, formerly Institutional Investor Research, announced BofA Global Research as one of the Top Global Research Firms in 2024 based on surveys held throughout the year. Extel creates rankings of the top research analysts in a wide variety of specializations, drawn from the choices of portfolio managers and other investment professionals. The 2024 Global Research Leaders ranking lists sell-side research providers by the combined total number of positions earned across Extel's 2024 research team surveys. Results of each survey are published separately throughout the year, beginning in March 2024 with the Japan Research Team and concluding in December 2024 with the Global Fixed Income Research Team. Rankings for each poll are determined strictly by using numerical scores. Extel takes the number of votes awarded to each firm in a sector and weight it in relation to the size of the institution responding and rating it awarded. Firms are designated runners-up when their scores fall within 35 percent of the third-place scores. BofA Global Research is research produced by BofA Securities, Inc ("BofAS") and/or one or more of its affiliates. BofAS is a registered broker-dealer, Member SIPC, and wholly owned subsidiary of Bank of America Corporation. Rankings and recognition from Extel are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement.

CEPA®, CPFA®, CPWA®

Bringing fresh perspectives to your financial life

The financial decisions you make today can help determine the future you build for yourself and your family. Carving a clear path forward starts with connecting your life and finances. A Merrill advisor provides access to the investing insights of Merrill and banking capabilities of Bank of America to help you make informed decisions as you pursue your goals.